Free Business Credit Scores

Unlock the potential of your business by keeping an eye on its credit score – and all with little effort. With Access Capital, you can take control of your company’s financial future today: get access to trade credit financing opportunities and check in on your performance without experiencing any adverse effects. Make sure that when it comes time for growth or expansion, you’re ready!

100% free. It won’t affect your credit score

What is a Business Credit Score?

Smart business owners understand that staying on top of their company’s credit score is key to successful management. Maintaining an up-to-date understanding can help make the difference between a loan being approved or rejected, and even influence whether cash advances, lines of credit, and other financial options are available to them.

For small business owners, finding funding options can be a daunting task. Our free app is designed to make the search easier by matching you with potential lenders best suited for your company’s needs – all in real time! Take advantage of our wide selection of lending partners who are eager to help your business grow and succeed based on the details generated from within our powerful credit check feature.

How Are Business Credit Scores Used?

Your business credit score is an invaluable tool for lenders, insurers and suppliers. It can determine how much financing you are eligible to receive, as well as the rates of your commercial insurance premiums.

Moreover, it provides vendors with a quick indication on whether they should extend terms or require payment upfront.

Maintaining a reliable business credit score is essential to the success and longevity of your organization.

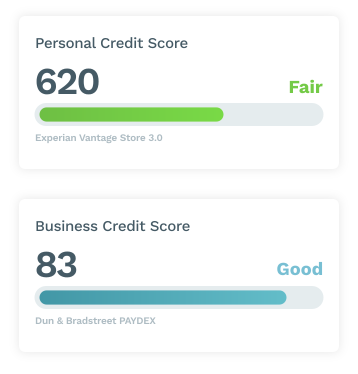

Business credit scores range from zero to 100, with most lenders requiring a minimum business credit score of 75.

Three credit reporting agencies — Dun & Bradstreet, Experian, and Equifax — are responsible for most traditional credit reporting.

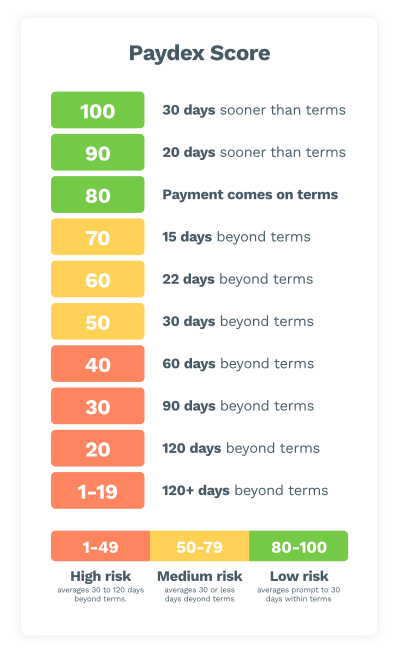

The Dun & Bradstreet PAYDEX score is a 1-100 rating based on a company’s payment history, with higher ratings going to companies that pay bills early.

Experian’s Intelliscore Plus uses a 1-100 rating derived from the number and status of a company’s commercial accounts as well as how long they’ve had a file in Experian’s database.

Equifax uses similar data as Experian to calculate a Business Credit Risk Score that ranges from 101 to 992.

Traditional business credit reports reports contain valuable information but suffer from several shortcomings

Know what lenders look for: Ready to get approved for a loan? Our innovative credit tools match you with the best products with the greatest approval odds.

Know what is behind your number: Maximizing your credit potential is easier than you think! We identify the most influential components of your score, so that taking action to improve it can be a breeze. Unlock unprecedented levels of financial freedom with only minimal effort on your end!

Build strong credit and financial health: With our revolutionary credit scoring tools, you’ll have around-the-clock access to your score and be the first to know when it changes. Break free from the traditional way of checking – now with more insight than ever!

COMPANY

RESOURCES